WHY PRECIOUS METALS

There is a wide range of reasons why you should consider owning physical gold and silver as a part of your retirement portfolio. Precious metals are one of the very few assets that you can physically hold in your possession. Unlike paper investments such as stocks, physical possession of gold and silver will help to complete your portfolio.

DIVERSIFICATION

Diversification is necessary to achieve a well-balanced investment portfolio. A range of investments in your portfolio, allows the negative performance of some investments to be absorbed by the positive performance of others. Precious metals often move opposite to the stock market. So, if the stock market drops, gold and silver often head higher. If you want to help balance your portfolio, precious metals can be one way to do it, by diversifying your assets in a way that can help to protect you from a market correction.

GROWTH POTENTIAL

Owning Precious Metals is one of the safest ways to protect and grow your family’s private wealth. With the constant fluctuations you see in the marketplace, you might find yourself a little hesitant to invest anywhere. If you are interested in safeguarding your financial portfolio, the time is now to move a portion of your assets into precious metals to hedge against inflation.

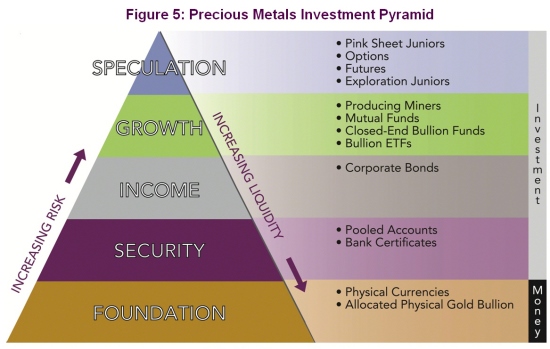

LIQUIDITY

Gold and silver are some of the most liquid assets you can own. Owning gold and silver can allow you to have something of value in your hands. Physical possession gives you the ability to sell your precious metals without having to go through the same hurdles as other investments. Gold and silver coins and bars are valued throughout the world, and can be sold or traded almost anywhere.

PRIVACY

Your investments are nobody’s business but your own. When you purchase precious metals for delivery, your purchases are entirely private. Having precious metals in your possession means no government or financial institution is involved in your personal financial decisions.

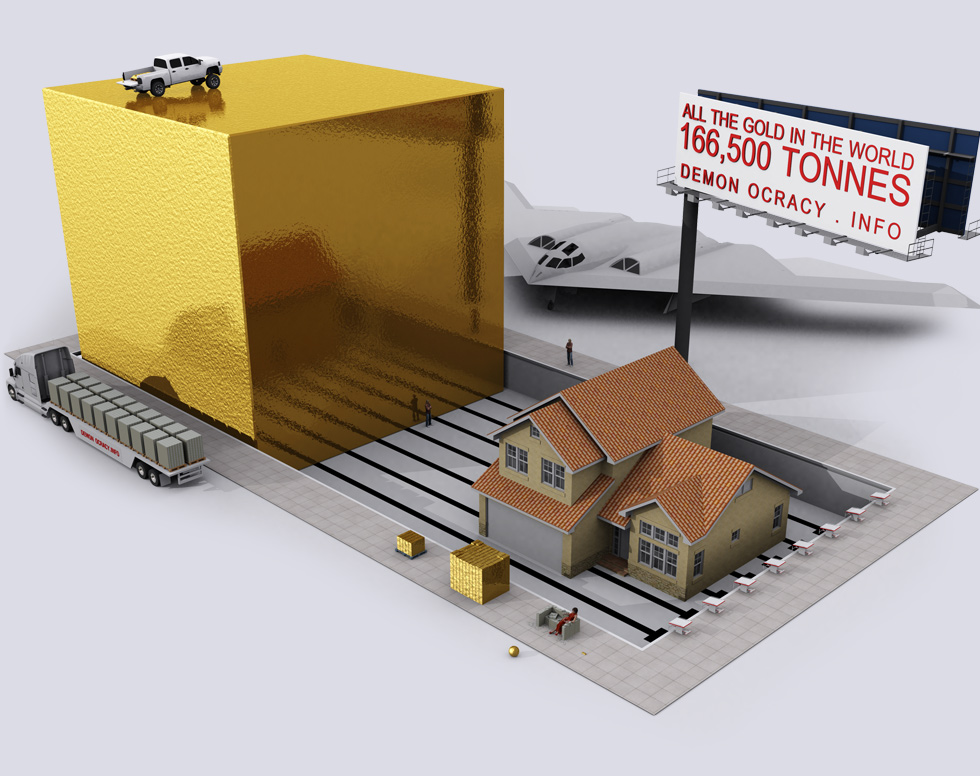

SUPPLY & DEMAND

The demand for physical gold and silver from central banks, governments, financial institutions, and industry are continuing to increase at levels not seen before. As political and economic uncertainty continues to grow, the demand for the safety and security offered by precious metals will only continue to rise. As technology continues to evolve, the need for gold and silver as

industrial metals will also continue to increase. With miners avoiding new projects amid global economic uncertainty, the prices of gold and silver could spike significantly as the available supply continues to decrease.