What is the Better Investment: Silver Coins or Silver Bars?

When it comes to investing in precious metals, silver continues to shine as a reliable choice. It’s more affordable than gold, accessible to a wider range of investors, and serves as a hedge against inflation and economic uncertainty. But here’s the big question: what should you buy—silver coins or silver bars?

Let’s break it down and help you make a smart, confident investment decision.

Silver Coins: The Collector’s Favorite

What Are Silver Coins?

Silver coins are government-minted pieces, often issued as legal tender, made from highly pure silver (usually .999 or higher). Popular examples include the American Silver Eagle, Canadian Silver Maple Leaf, and Austrian Silver Philharmonic.

Advantages of Investing in Silver Coins

- Liquidity & Recognition

Silver coins are globally recognized and easy to trade. Dealers and collectors are very familiar with them, making resale easier. - Government-Backed Assurance

Minted and backed by national governments, silver coins often come with added credibility and security in terms of weight and purity. - Numismatic Value

Some silver coins can appreciate in value due to rarity, age, or condition—offering potential returns beyond the spot price of silver. - Easy to Store & Sell in Small Quantities

Coins are perfect if you prefer to sell a portion of your holdings at a time.

Downsides of Silver Coins

- Higher Premiums:

Silver coins typically have higher premiums over spot price due to minting costs, demand, and collectability - Not Ideal for Bulk Investments:

If you’re looking to invest a large sum, buying many coins might not be cost-effective.

Learn what makes silver coins unique and how they’re different from regular bullion.

Why Investors Love Silver Coins

- Globally Recognized Value

- Government-Backed Assurance

- Collector Demand and Rarity

- Sell as You Go: Flexible Investment Strategy

When Silver Coins Might Not Be Ideal

- Are you paying too much in premiums?

- Is collecting slowing down your portfolio growth?

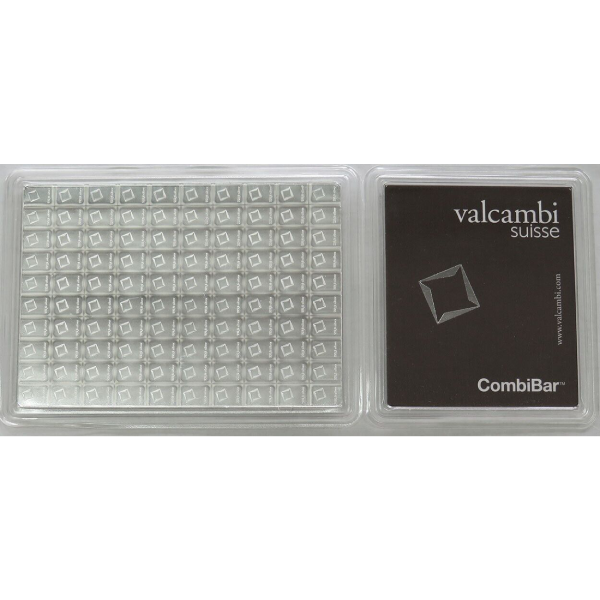

Silver Bars: The Bullion Investor’s Choice

What Are Silver Bars?

Silver bars are privately or government-minted bullion products. They come in a variety of weights—1 OZ, 5 OZ, 10 OZ, 1 kilo, and even 100 OZ. The most common purity is .999 fine silver.

Advantages of Investing in Silver Bars

- Lower Premiums over Spot Price

If you’re aiming for maximum silver for your dollar, silver bars offer better value per ounce compared to coins. - Ideal for Large Investments

Investing in 1 kilo or 100 OZ bars allows you to hold significant amounts of silver with fewer pieces, making storage and management easier. - Easier for Long-Term Holdings

Bars are great for long-term investors who aren’t planning to sell portions of their silver frequently.

Downsides of Silver Bars

- Less Liquidity

While bars are widely accepted, they’re not as universally recognized as silver coins. Resale may take longer, especially with larger bars. - No Numismatic Value

Silver bars are valued purely on weight and purity—there’s no collector premium to gain.

Why Silver Bars Are a Bullish Bet

- More Silver for Less Money

- Ideal for High-Volume Investors

- Simplified Long-Term Storage

Things to Consider Before Buying Silver Bars

- Lower liquidity for large bars

- No collector value or rarity premiums

Key Differences at a Glance

| Feature | Silver Coins | Silver Bars |

| Premium | Higher | Lower |

| Liquidity | Higher | Slightly lower |

| Resale Ease | Excellent | Good |

| Storage | Easy for small amounts | Efficient for large amounts |

| Collector Appeal | High | Low |

| Ideal For | New investors, collectors | Bulk buyers, long-term holders |

So, which is better for you?

There’s no one-size-fits-all answer—it all depends on your goals.

- If you’re a first-time investor, want greater liquidity, or enjoy the thrill of collecting, silver coins may be the right choice.

- If you’re looking for bulk silver at lower premiums and plan to hold for the long term, silver bars might be the better path.

Many savvy investors choose to diversify—holding both silver coins and bars to balance accessibility, liquidity, and long-term value.

FAQs for “Silver Coins vs. Silver Bars”

1. Are silver coins more valuable than silver bars?

Not always. Silver coins may carry collector premiums or numismatic value, while silver bars offer more silver for your money due to lower premiums.

2. Which is better for beginners—silver coins or silver bars?

Silver coins are often better for beginners due to their liquidity, government backing, and smaller denominations that make buying and selling easier.

3. Do silver bars hold their value over time?

Yes, silver bars track the spot price of silver and are an excellent choice for long-term investors seeking value with lower premiums per ounce.

4. Can I mix silver coins and silver bars in my portfolio?

Absolutely! Many investors diversify with both to enjoy the liquidity of coins and the cost efficiency of bars.

5. Is it easier to sell silver coins or silver bars?

Generally, silver coins are easier to sell due to their wide recognition and demand from collectors. However, bars are also sellable through reputable dealers.

Final Thoughts: Silver Coins vs. Silver Bars

Whether you lean toward coins or bars, silver remains a smart way to diversify your portfolio. Understanding your goals—whether it’s ease of liquidation, collectible value, or maximizing silver per dollar—will help you make the right call.

At the end of the day, investing in silver coins or silver bars is less about picking a winner and more about building a balanced, strategic portfolio.

Ready to invest? Explore our curated selection of silver coins and silver bars at Gibraltarira.com—your trusted partner in precious metals.