Top 5 Reasons Smart Retirees Are Choosing Silver IRAs in 2025

As 2025 unfolds, an increasing number of retirees are turning to Silver IRAs as a smart and secure addition to their retirement portfolios. In the face of economic uncertainty, inflationary pressure, and global instability, Silver IRAs offer a unique blend of safety, value, and growth potential. In this blog post, we’ll explore the top 5 reasons savvy retirees are choosing Silver IRAs and how these precious metal investments can play a crucial role in protecting and growing their nest eggs. This guide is brought to you by Gibraltar Group LLC, your trusted partner in precious metals retirement planning.

1. Hedge Against Inflation and Economic Volatility

Inflation erodes the purchasing power of your savings. With rising costs for everything from groceries to healthcare, many retirees are finding that traditional investments just don’t keep pace. Silver, as a tangible asset, has historically maintained its value during inflationary periods.

Why Silver is Effective Against Inflation:

| Factor | Impact |

| Tangible Asset | Silver retains value regardless of currency fluctuations |

| Limited Supply | Demand often exceeds mining capacity, increasing value |

| Inverse Dollar Relationship | When the dollar weakens, silver typically gains |

Silver IRAs allow retirees to diversify away from paper assets, creating a solid foundation that offers resilience during turbulent times.

2. Portfolio Diversification

Diversification is key to reducing risk in any investment portfolio. Silver IRAs provide an opportunity to move away from heavily stock- or bond-reliant strategies.

Key Diversification Benefits:

| Diversification Type | Benefits |

| Asset Class | Silver behaves differently than stocks and bonds |

| Sector Independence | Precious metals are less affected by sector-specific downturns |

| Safe Haven Status | Silver performs well in market downturns and crises |

Smart retirees are rebalancing their portfolios with silver to reduce volatility and protect against market corrections.

3. Tax Advantages of a Silver IRA

Just like traditional IRAs, Silver IRAs offer potential tax benefits depending on the type of account (Traditional or Roth).

Tax Perks Overview:

| IRA Type | Tax Advantage |

| Traditional | Contributions may be tax-deductible, earnings grow tax-deferred |

| Roth | Contributions are post-tax, but qualified withdrawals are tax-free |

These benefits can help retirees preserve more of their investment gains while enjoying the peace of mind that comes with a secure asset.

4. Long-Term Growth Potential

Silver is not only a hedge and a store of value; it also has strong growth potential due to industrial demand, particularly in technology, medicine, and green energy sectors.

Industrial Demand Drivers:

| Industry | Use of Silver |

| Electronics | Conductors in smartphones, tablets, and computers |

| Solar Energy | Crucial in photovoltaic cells for solar panels |

| Medical | Antibacterial and conductive uses in instruments |

These factors contribute to a robust outlook for silver’s long-term value, making it an attractive option for retirees seeking growth.

5. Security and Control of Physical Assets

Unlike stocks or mutual funds, silver in an IRA is a physical asset stored in a secure, IRS-approved depository. This gives retirees peace of mind knowing their wealth isn’t just digits on a screen.

Physical Asset Benefits:

| Feature | Advantage |

| Tangibility | Physical ownership means real, holdable value |

| Custodial Safety | Stored in highly secure depositories with insurance |

| Diversified Storage | Options include domestic and international storage facilities |

Many retirees prefer the transparency and control that comes with knowing where and how their investments are stored.

How to Get Started with a Silver IRA in 2025

If you’re considering opening a Silver IRA, here are a few steps to help you get started:

- Choose a Reputable Custodian: Look for IRA custodians specializing in precious metals, like Gibraltar Group LLC.

- Fund Your IRA: You can transfer or roll over existing retirement funds into your Silver IRA.

- Select Your Metals: Choose from IRS-approved silver coins or bullion.

- Storage Arrangement: Your custodian will help you store your metals in an approved depository.

Silver IRA vs. Traditional IRA: Key Differences

To better understand the advantages of a Silver IRA, it helps to compare it directly with a traditional IRA.

| Feature | Silver IRA | Traditional IRA |

| Asset Type | Physical silver | Stocks, bonds, mutual funds |

| Inflation Hedge | Strong | Moderate |

| Physical Ownership | Yes | No |

| Market Volatility | Less correlated | More correlated |

| Storage | IRS-approved depositories | N/A |

This side-by-side comparison illustrates why many retirees consider Silver IRAs a smart hedge and diversification tool.

Is Now the Right Time to Invest in Silver IRAs?

2025 is shaping up to be a pivotal year for retirement planning. With central banks signaling ongoing interest rate volatility, and inflationary concerns persisting worldwide, the timing is ideal for incorporating silver into retirement strategies. Market analysts predict that silver could outperform many other asset classes in the coming years due to growing industrial demand and constrained supply.

Indicators Supporting Silver Growth:

- Increasing demand from tech and green energy sectors

- Limited new mining projects

- Continued global geopolitical tensions

For many, now is an opportune moment to get ahead of potential silver price increases and lock in physical assets at today’s values.

Frequently Asked Questions (FAQs) About Silver IRAs in 2025

1. What is a Silver IRA?

A Silver IRA is a self-directed individual retirement account that allows you to invest in silver bullion or coins instead of traditional stocks and bonds.

2. Is silver a better investment than gold in 2025?

While gold is more expensive, silver often offers higher growth potential due to industrial demand. Many experts consider silver undervalued compared to gold.

3. Can I roll over my 401(k) into a Silver IRA?

Yes, you can roll over funds from a 401(k) or existing IRA into a Silver IRA without incurring taxes or penalties if done properly.

4. Are Silver IRAs safe?

Silver IRAs are considered safe as they are backed by physical silver stored in insured, IRS-approved depositories.

5. What types of silver can I hold in my IRA?

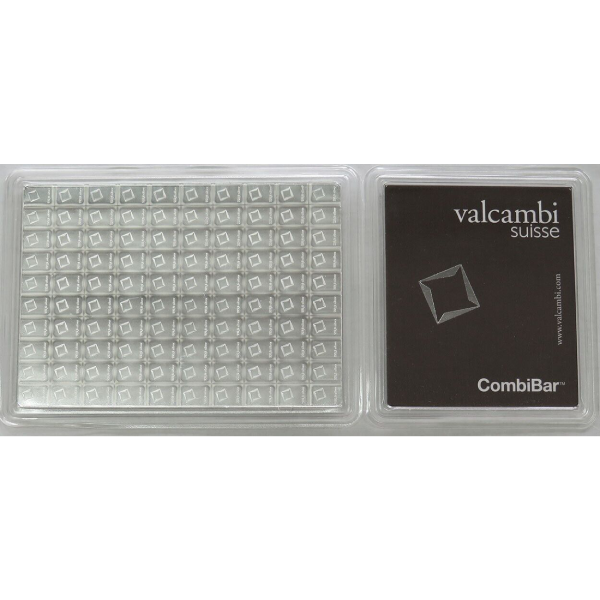

You can hold IRS-approved silver bullion and coins like American Silver Eagles, Canadian Maple Leafs, and bars from approved refiners.

6. How is silver stored in a Silver IRA?

The silver is stored offsite in a secure, insured depository that meets IRS standards for precious metal storage.

7. What are the fees associated with a Silver IRA?

Fees typically include setup, annual maintenance, and storage fees. These vary by custodian, so it’s important to compare providers like Gibraltar Group LLC for transparency and value.

Final Thoughts

With its inflation protection, diversification benefits, tax advantages, growth potential, and physical security, a Silver IRA is a smart move for retirees in 2025. As you plan for your financial future, consider how this precious metals retirement account can help secure and grow your wealth.

For personalized advice, consult a trusted financial advisor or reach out to Gibraltar Group LLC, an experienced provider in Silver IRA investments. Investing wisely today can ensure a more comfortable, secure tomorrow.