Is Silver a Better Deal Than Gold

Whether silver is a better deal than gold depends on a few factors, including market conditions, your investment goals, and your risk tolerance. Here’s a breakdown:

1. Price and Affordability:

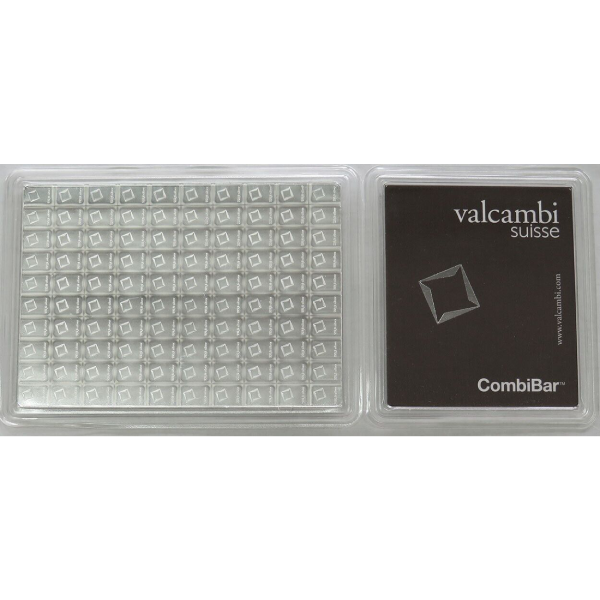

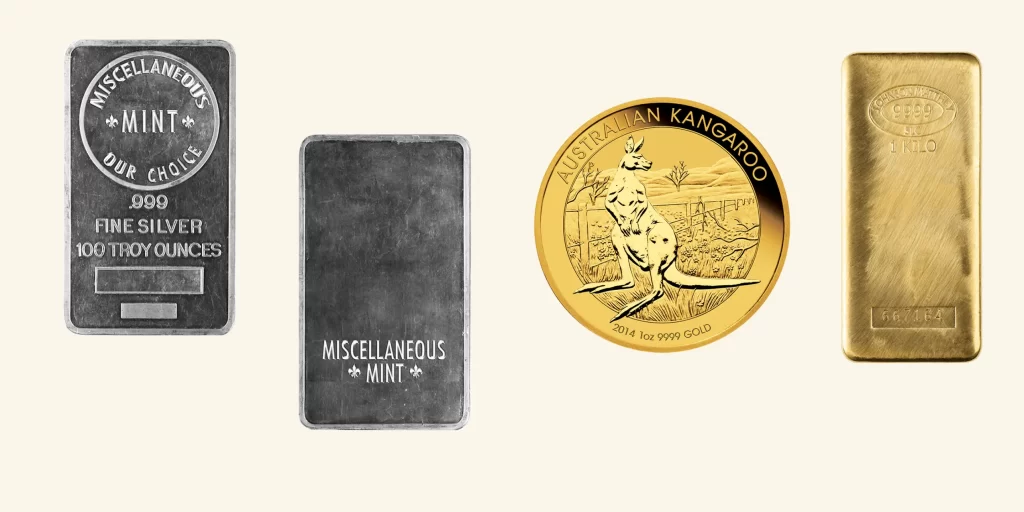

- Silver is significantly cheaper than gold per ounce, which makes it more accessible for small investors. This means you can acquire more physical silver for the same amount of money compared to gold, which could appeal to some people.

- Gold has a higher price, which could make it a more stable and long-term investment, but it may be out of reach for smaller investors looking to buy physical metal.

2. Market Volatility:

- Silver tends to be more volatile than gold. It reacts more drastically to market changes, economic conditions, and geopolitical events. While this can mean higher potential gains, it also implies higher risk. Investors looking for potentially higher returns (but with more risk) might prefer silver.

- Gold is generally seen as a safe haven in times of economic instability, offering more stability, though the returns are often more modest.

3. Industrial Demand:

- Silver has a wider industrial demand than gold. It’s used in electronics, solar panels, medical devices, and more. This industrial demand can influence silver’s price, potentially making it a good option if you believe in technological growth and the increasing need for silver.

- Gold has limited industrial uses compared to silver, with much of its demand driven by jewelry and investment (including central banks). This makes it more reliant on investor sentiment and store-of-value purposes.

4. Long-Term Value:

- Historically, gold has been viewed as a store of value and a hedge against inflation. It’s been a standard of wealth for thousands of years, and many people see it as a more stable long-term investment.

- Silver, while also a store of value, has seen larger price swings, making it less predictable. However, over the long term, it can outperform gold in terms of percentage gains due to its volatility.

5. Market Dynamics and Ratios:

- The gold-to-silver ratio (how many ounces of silver it takes to buy one ounce of gold) can help determine which metal is “cheaper” at any given time. Historically, this ratio fluctuates, and some investors buy silver when the ratio is high, expecting silver to catch up with gold in value.

In Summary:

- If you want affordability and are willing to take on more volatility for higher potential short-term gains, silver might be a better deal for you.

- If you’re looking for a more stable, long-term investment with a long history of maintaining value, gold might be the safer choice.