Can Farmers Use Precious Metals as a Hedge Against Economic Volatility?

Introduction

Economic volatility, marked by inflation, fluctuating commodity prices, and currency devaluation, poses a significant challenge for farmers. To mitigate these uncertainties, farmers often diversify their investments. One potential strategy is investing in precious metals like gold and silver. But can farmers effectively use precious metals as a hedge against economic instability? Let’s explore this concept in detail.

Understanding Economic Volatility in Agriculture

Farmers face several economic risks, including:

- Inflation: Rising costs of seeds, fertilizers, and machinery can erode profits.

- Market Fluctuations: Crop prices depend on global demand and supply trends.

- Currency Instability: A weaker currency increases import costs but may boost exports.

- Unpredictable Weather Conditions: Climate changes impact yields and profitability.

Given these challenges, securing financial stability becomes crucial. Precious metals may serve as a protective measure against these risks.

Why Precious Metals Are a Safe Haven

Precious metals have historically been used as a hedge against economic downturns. Here’s why:

- Inflation Hedge: Gold and silver retain value when fiat currency declines.

- Store of Value: Unlike paper money, metals don’t deteriorate or become obsolete.

- Liquidity: Easily convertible to cash when needed.

- Diversification: Adds stability to a portfolio dominated by agricultural assets.

How Farmers Can Invest in Precious Metals

There are multiple ways for farmers to incorporate precious metals into their financial strategy:

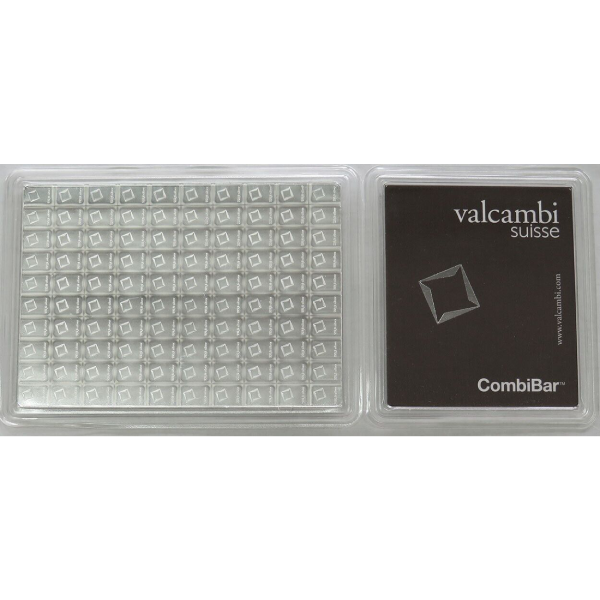

- Physical Metal Ownership

- Buying gold and silver coins or bars.

- Storing them securely in banks or private vaults.

- Ideal for long-term wealth preservation.

- Gold and Silver IRAs

- Silver Coins and Silver Bars

- Investing in silver coins and silver bars provides a hedge against inflation.

- Easily stored and highly liquid assets.

- Ideal for both short-term and long-term wealth preservation.

- Gold Coins and Gold Bars

- Gold coins and gold bars offer a secure way to protect wealth.

- Recognized globally for their intrinsic value.

- Can be easily traded or sold when needed.

- Precious Metal IRAs

- Tax-advantaged retirement accounts holding metals.

- Protects against inflation over time.

- A long-term strategy for financial security.

The Risks and Considerations

While precious metals provide economic security, they come with challenges:

- Price Fluctuations: Gold and silver prices can be volatile in the short term.

- Storage and Security Costs: Physical metals require secure storage, adding expenses.

- Opportunity Cost: Money invested in metals may not yield the same returns as reinvestment in farm operations.

- Market Liquidity: Selling metals at a fair price may take time during market downturns.

FAQs About Farmers Using Precious Metals as a Hedge

1. Why should farmers invest in precious metals?

Farmers face financial risks due to inflation, market fluctuations, and economic downturns. Investing in precious metals like gold, silver, and platinum can provide a stable store of value and act as a hedge against currency devaluation.

2. How can farmers buy precious metals?

Farmers can purchase precious metals in various forms, including gold and silver coins, bars, and bullion, through reputable dealers, banks, or online investment platforms. They can also invest through a Gold IRA or Silver IRA for long-term tax benefits.

3. Are precious metals better than traditional farm investments?

While farmland, equipment, and crops are essential agricultural investments, precious metals offer financial stability during economic downturns. They don’t depreciate like machinery and can protect against inflation.

4. What type of precious metals are best for farmers?

Gold and silver are the most popular choices due to their liquidity and stability. Silver bars, gold coins, and silver IRAs can be particularly beneficial for farmers looking for long-term wealth preservation.

5. Can farmers use silver and gold as collateral for loans?

Yes, many financial institutions allow farmers to use gold bars, silver coins, and other precious metals as collateral for loans, helping them secure financing during tough economic periods.

Conclusion

Farmers can indeed use precious metals as a hedge against economic volatility. Gold IRA and silver IRA accounts provide protection against inflation, currency instability, and financial downturns. Additionally, investing in silver coins and gold bars offers a tangible store of value. However, they should be part of a well-balanced investment strategy rather than the sole financial safeguard. By carefully weighing the risks and benefits, farmers can leverage precious metals to enhance financial stability while continuing to grow their agricultural businesses.

Are you considering diversifying your investment portfolio? Explore how gold IRAs, silver IRAs, and precious metal investments can strengthen your financial future today!