Silver Bars VS Silver Coins – What’s Better for Your IRA in 2025?

When planning for retirement, diversification is the name of the game. Precious metals like silver have become an increasingly popular option for self-directed IRAs. But within the world of silver investing, one question continues to spark debate: Should you invest in silver bars VS silver coins in your IRA?

In this blog, we’ll break down the key differences, advantages, and disadvantages of silver bars and silver coins — so you can make a more informed decision for your IRA in 2025 and beyond.

Why Silver in an IRA Makes Sense

Before diving into bars vs. coins, let’s address why silver belongs in an IRA in the first place.

- Hedge Against Inflation: Silver, like gold, tends to hold its value during periods of economic uncertainty and rising inflation.

- Tangible Asset: Unlike stocks or bonds, silver is a physical asset you can actually hold.

- Diversification: It offers an alternative to traditional assets, reducing overall portfolio risk.

Self-directed IRAs allow you to include IRS-approved silver products, offering tax advantages while holding tangible wealth.

Benefits of Silver IRAs: Why Silver May Outperform in 2025

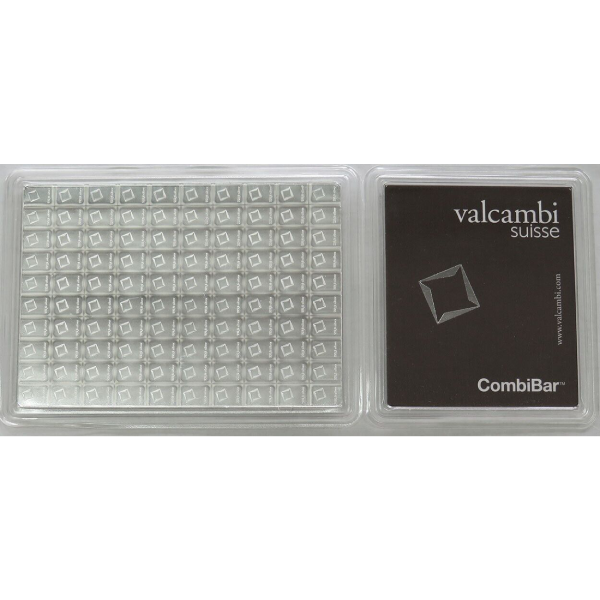

Silver Bars: Simplicity and Value

Pros of Silver Bars for IRAs

- Lower Premiums: Silver bars typically have lower premiums over spot price compared to coins, making them cost-effective for large investments.

- Easier to Store in Bulk: Ideal for high-volume investments, especially 1 kilo silver bars or 100 oz silver bars.

- Higher Purity: Most bars have a purity of .999 or higher, making them eligible for IRA inclusion.

- Straightforward Valuation: Their value is directly tied to their weight and the spot price.

Cons of Silver Bars

- Limited Liquidity: Harder to sell in small amounts; not ideal if you need to liquidate just a portion.

- Less Recognizable: May not be as easily recognized or trusted by smaller buyers compared to well-known coins.

Best for: Investors looking to hold silver long-term in large quantities with minimal premiums.

Silver Coins: Liquidity and Recognition

Pros of Silver Coins for IRAs

- Global Recognition: Coins like the American Silver Eagle, Canadian Maple Leaf, or Britannia are trusted and highly liquid worldwide.

- Smaller Denominations: Easier to sell in parts, making them more flexible for withdrawals or trades.

- Numismatic Value: Some coins may increase in value over time due to rarity or demand.

- Government Backed: Many silver coins are backed by sovereign mints, adding authenticity.

Cons of Silver Coins

- Higher Premiums: You’ll often pay more over spot price due to design, minting, and demand.

- Bulkier to Store: Storing large quantities requires more space than bars.

Best for: Investors who value flexibility, liquidity, and may want to sell portions over time.

IRA Rules for Silver: What You Need to Know

Whether you choose bars or coins, the IRS has strict rules for precious metals in IRAs:

- Only approved bullion (usually .999 purity or higher) is allowed.

- Must be held by a qualified custodian — you can’t store it at home.

- Certain collectible coins (like rare numismatic coins) are not allowed.

- Silver products must be produced by accredited refiners or government mints.

Always consult your IRA custodian to ensure your silver products are compliant.

Silver Bars VS Silver Coins – Head-to-Head Comparison

| Feature | Silver Bars | Silver Coins |

| Cost Over Spot | Lower premiums | Higher premiums |

| Liquidity | Lower (in small amounts) | High liquidity |

| Storage Efficiency | More compact for large volumes | Bulkier |

| Recognizability | Less recognizable | Globally trusted (e.g., American Eagle) |

| IRA Eligibility | Must meet IRS standards | Must meet IRS standards |

| Flexibility | Less flexible | Ideal for partial liquidations |

What’s Better for Your IRA in 2025?

There’s no one-size-fits-all answer — it depends on your investment goals.

Choose Silver Bars if:

- You want more silver for your money.

- You’re a long-term holder with minimal need for frequent liquidity.

- You’re investing large sums and value efficient storage.

Choose Silver Coins if:

- You prefer ease of liquidation in small amounts.

- You want high recognizability and trust.

- You’re okay with paying a bit more for added flexibility.

Gibraltar Group’s Take: A Balanced Approach

At Gibraltar Group, we’ve helped thousands of clients build and protect wealth through precious metal IRAs. Our experience tells us that the best strategy often involves a mix of both:

- Use silver bars for foundational, long-term value.

- Use silver coins for liquidity and future flexibility.

Our team can help you structure a self-directed IRA that balances cost, accessibility, and compliance with IRS rules.

FAQs

Q1: Are silver bars or silver coins better for an IRA?

It depends on your investment goals. Silver bars offer lower premiums and efficient storage, while silver coins provide better liquidity and global recognition.

Q2: Are silver bars IRA-eligible?

Yes, silver bars are eligible for a Silver IRA if they meet IRS requirements: at least .999 purity and produced by an approved refiner or mint.

Q3: Do silver coins have higher premiums than silver bars?

Yes, silver coins typically have higher premiums due to minting costs, demand, and government backing, but they offer better liquidity.

Q4: Can I mix silver bars and coins in my IRA?

Absolutely. A diversified Silver IRA that includes both bars and coins can offer cost efficiency and liquidity for a balanced retirement strategy.

Q5: Which silver coins are approved for IRA investment?

Common IRA-approved silver coins include the American Silver Eagle, Canadian Maple Leaf, Austrian Philharmonic, and Australian Kangaroo.

Final Thoughts

Whether you lean toward silver bars or silver coins, what matters most is that you’re diversifying and protecting your retirement savings. In 2025, with market volatility and inflation concerns on the rise, precious metals remain a solid hedge.

If you’re ready to start or grow your Silver IRA, contact Gibraltar Group today — and let’s make your retirement future stronger, one silver ounce at a time.