Best Time to Convert 401(k) to Roth IRA

Best Time to Convert Your 401(k) to a Roth IRA or Precious Metals IRA

Converting your 401(k) into a Roth IRA or a precious metals IRA can be a strategic move to optimize your retirement savings and hedge against economic uncertainties. Timing is crucial to maximize benefits and minimize tax liabilities. This guide will help you determine the optimal time to make this conversion and explore the advantages of including assets like gold bars and silver bars in your retirement portfolio.

Understanding Roth IRA and Precious Metals IRA Conversions

Roth IRA Conversion

A Roth IRA conversion involves transferring funds from a traditional 401(k) or IRA into a Roth IRA. While this move requires paying taxes on the converted amount in the year of the conversion, it offers significant advantages:

- Tax-Free Withdrawals: Qualified withdrawals from a Roth IRA are tax-free, providing potential tax savings in retirement.

- No Required Minimum Distributions (RMDs): Unlike traditional retirement accounts, Roth IRAs do not mandate RMDs during the account holder’s lifetime, allowing your investments to grow uninterrupted.

- Estate Planning Benefits: Roth IRAs can be passed on to heirs, offering them tax-free income, which can be a valuable estate planning tool.

Precious Metals IRA Conversion

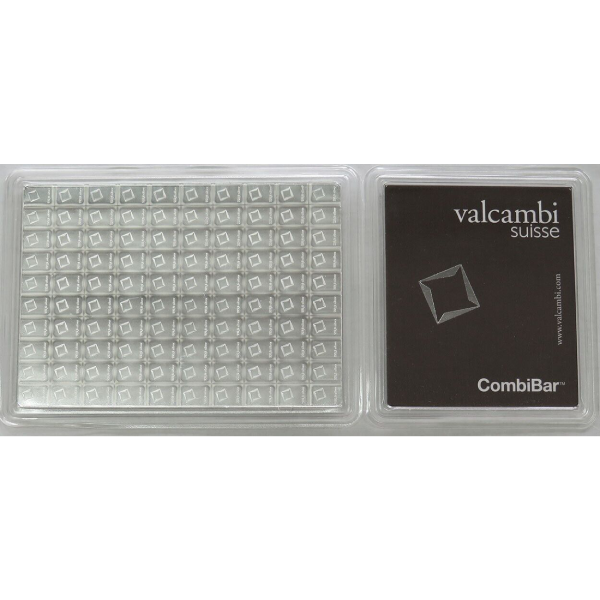

A precious metals IRA, such as a gold IRA or silver IRA, allows you to hold physical precious metals like gold bars and silver bars within a self-directed IRA. This type of IRA offers:

- Diversification: Including tangible assets like gold and silver can diversify your portfolio and reduce risk.

- Inflation Hedge: Precious metals often retain value during inflationary periods, protecting your purchasing power.

- Tax Advantages: Similar to traditional IRAs, precious metals IRAs offer tax-deferred growth, and Roth versions provide tax-free withdrawals.

Read more: about How to Start a Precious Metals IRA: Safe or Risky in 2025?

Optimal Timing for Conversion

1. During Low-Income Years

Converting during years when your income is lower can reduce the tax impact of the conversion. This scenario often occurs:

- Between retirement and the start of Social Security benefits.

- During a career break or sabbatical.

- In years with significant deductions or losses.

By converting in these periods, you may fall into a lower tax bracket, minimizing the taxes owed on the converted amount.

2. Before RMDs Begin

RMDs from traditional retirement accounts typically start at age 73. Converting to a Roth IRA or precious metals IRA before this age can:

- Reduce future RMD amounts, lowering taxable income in retirement.

- Provide more control over your taxable income and potential tax bracket in later years.

3. When Market Values Are Down

Market downturns can be an opportune time for conversion:

- Lower account balances mean paying taxes on a smaller amount.

- Potential for greater tax-free growth when markets rebound.

4. Early in the Year

Converting early in the calendar year allows:

- More time for the investments to grow tax-free within the Roth IRA or precious metals IRA.

- Flexibility to manage and plan for the tax bill due the following year.

Steps to Convert Your 401(k) to a Precious Metals IRA

- Open a Self-Directed IRA: Choose a custodian that specializes in precious metals IRAs.

- Fund the Account: Initiate a rollover from your 401(k) to the new self-directed IRA.

- Purchase Precious Metals: Select IRS-approved gold bars, silver bars, or other eligible precious metals to include in your IRA.

- Secure Storage: Ensure your precious metals are stored in an IRS-approved depository.

Considerations Before Converting

- Tax Implications: The converted amount is added to your taxable income for the year, which could push you into a higher tax bracket.

- Payment of Taxes: Ensure you have funds outside of your retirement accounts to pay the tax bill, preserving the full amount in your Roth IRA or precious metals IRA for growth.

- Five-Year Rule: Withdrawals of converted funds are subject to a five-year holding period to avoid penalties, regardless of age.

- Storage and Fees: Precious metals IRAs may involve storage fees and require secure storage solutions.

FAQs

1. What is the best age to convert a 401(k) to a Roth IRA or a Precious Metals IRA?

The best time is typically between ages 59½ and 73 — after penalty-free withdrawals begin and before Required Minimum Distributions (RMDs) start. This window allows you to convert when taxes may be lower and optimize long-term retirement growth, especially if you’re considering assets like gold bars or silver bars in a precious metals IRA.

2. Can I convert my 401(k) into a Gold IRA or Silver IRA?

Yes, you can roll over your 401(k) into a self-directed Gold IRA or Silver IRA. This allows you to hold physical precious metals like gold bars and silver bars within your retirement account, providing diversification and a hedge against inflation.

3. Will I owe taxes when converting my 401(k) to a Roth IRA or Gold IRA?

Yes. Roth IRA conversions are taxable events. You’ll pay income tax on the converted amount. However, future qualified withdrawals will be tax-free. Precious metals IRA rollovers from a traditional 401(k) are tax-deferred if done properly through a trustee-to-trustee transfer.

4. Why should I consider precious metals like gold or silver in my retirement plan?

Gold and silver are tangible assets that protect against inflation, currency devaluation, and market volatility. Including gold bars or silver bars in your IRA can add long-term stability to your portfolio, especially during economic downturns.

5. Is now a good time to convert to a Roth IRA or invest in precious metals?

It may be, especially if you’re in a lower tax bracket or the market is down. Lower asset values mean you’ll pay less in taxes now and benefit from tax-free growth in the future. Many investors also choose this time to move into safe-haven assets like gold IRAs or silver IRAs due to market uncertainty.

Final Thoughts

Converting your 401(k) to a Roth IRA or a precious metals IRA can be a powerful strategy for retirement planning, offering tax advantages and portfolio diversification. Timing your conversion during low-income years, before RMDs begin, or during market downturns can enhance the benefits. Including assets like gold bars and silver bars in your retirement portfolio can provide a hedge against inflation and economic volatility. Consult with a financial advisor to assess your individual situation and develop a conversion strategy that aligns with your retirement goals.